Since 2018, AI has been essential to CTBC’s digital strategy, supported by its in-house R&D lab with 200-plus data and AI-focused scientists. This initiative now spans more than 50 departments across three major business lines. With over 100 active AI applications in production, the bank achieved an explosive 150% increase in AI usage year-over-year. Wang underscores CTBC’s vision: “Our goal is to scale AI implementation and deliver tangible benefits.”

CTBC aims to leverage both GenAI and traditional AI to enhance its personalized banking experience and seamlessly deliver next-gen banking services.

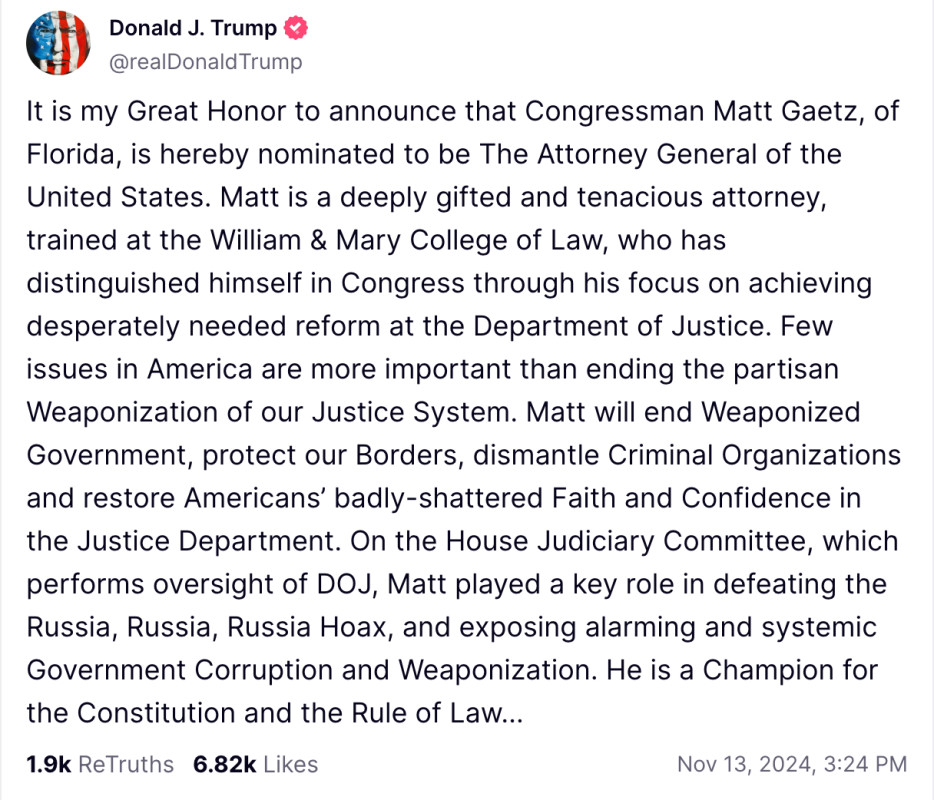

Real-Time Fraud Prevention with AI

Digital account fraud is a significant issue for global financial services, increasing 45% annually. Using AI, CTBC has defied the trend: Its innovative AI Skynet fraud detection system reduced fraud in its credit card accounts by 6% in 2024. Wang attributes AI Skynet’s success to its robust technology:

“For each transaction, the AI model can evaluate 100,000 fraud rules within 30 milliseconds.”

CTBC plans to expand real-time AI detection beyond credit cards to all transactions in the coming year. The bank is also piloting applications to use AI models in anti-money laundering systems and will continue to collaborate with government and law enforcement agencies to prevent fraud across the ecosystem.

Sustainable AI Development

After years of testing, CTBC identified six mainstream technologies that underpin their digital evolution. Wang said, “To be sustainable, AI efforts must solve for these challenges: revenue generation, process efficiency, OCR for digitizing paperwork, identity verification, insight generation, and RegTech for risk management. This ensures we build the best use cases for our customers and the business.”

Future innovations will utilize OCR technology to digitize complex documents and advanced facial recognition through multi-modal verification technology. CTBC is leveraging data resources from both retail and corporate banking, providing deeper enterprise-wide insights.

Data + Governance + Talent

GenAI requires high volumes of data, but Wang explained, “transaction data from our customers is good, but not enough to extend GenAI. To provide value, we input the knowledge and insights of our experienced senior bankers into the AI brain.” He says CTBC’s Data Centre needs both “the right governance and the right talent” to implement GenAI successfully.