Author: Niccolo Ricci, CEO, Stefano Ricci

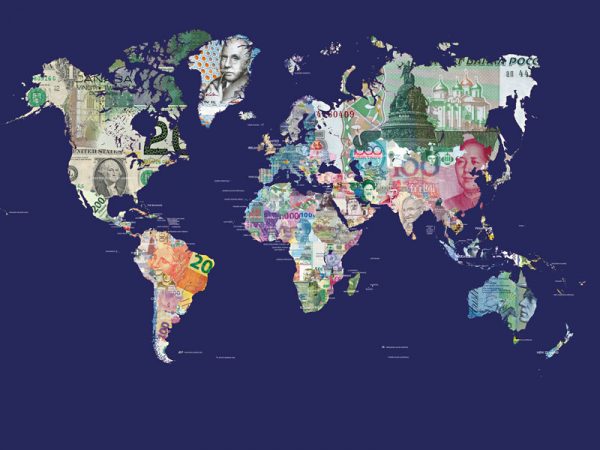

In 2023, the luxury sector demonstrated robust growth, despite facing global economic complexities, an overall slowdown in consumer demand, and inconsistent performance across different markets. Bain & Company reported a global market value of €1.5trn, with personal luxury goods reaching €362bn – a four percent increase at current exchange rates and eight percent at constant rates. Notably, menswear emerged as a rapidly expanding segment, driven by the demand for high-quality, classic pieces reflecting brand heritage – a trend corroborated by our group’s recent results.

Entering 2024, the luxury sector faced additional hurdles, including adapting to a swiftly changing digital landscape and combating counterfeiting while upholding ethical supply chains. The geopolitical environment, including the Russia-Ukraine war and most recently the Israel-Palestine conflict, has also presented challenges for sector growth. Despite these obstacles, the sector has demonstrated resilience, emphasising its ability to thrive amid volatility. As the year progresses, luxury brands must continue to navigate geo-political and economic challenges, technological shifts, and evolving consumer preferences. This adaptability is essential as brands aim to meet the sophisticated demands of a global consumer base seeking authenticity, sustainability, and exceptional quality.

Navigating new norms

The luxury market is experiencing significant changes in 2024, influenced by economic shifts and an evolving demographic profile. The Knight Frank and Douglas Elliman 2024 Wealth Report highlights a 4.2 percent increase in global ultra-high-net-worth individuals (UHNWIs), with notable growth in North America, the Middle East, and Africa. This surge provides luxury brands with opportunities as $90trn in assets is set to transfer from baby boomers to their children, setting the stage for millennials to become the wealthiest generation ever.

However, capturing this wealth requires more than traditional strategies and this becomes even more imperative in the face of Bain & Company’s prediction that younger generations (Generations Y, Z, and Alpha) will emerge as the predominant consumers of luxury goods, accounting for nearly 85 percent of global purchases by 2030 (see Fig 1).

Today’s affluent consumers, especially millennials and Gen Z, demand authenticity, sustainability, and ethical practices from luxury brands, reshaping the market’s landscape. These consumers are not just looking for prestige but also for a genuine commitment to social values and environmental responsibility.

Sustainability has become a crucial aspect of luxury branding. The younger generation’s environmental concerns are prompting luxury brands to adopt sustainable practices and transparently communicate these efforts, moving sustainability from a trend to a business imperative and an integral part of their global legacy.

Digital transformation is also critical. As wealth mobility and younger consumers’ digital fluency increase, luxury brands must integrate advanced technologies such as AI to enhance online and in-store experiences. AI can enable brands to drive design with data insights, authenticate products, optimise supply chains, and much more. These innovations are not just about keeping pace with technology but are crucial for connecting with a digitally native audience, thereby ensuring that luxury brands remain relevant in an ever-evolving market landscape.

Additionally, according to Bain & Company, the retail landscape is witnessing a remarkable shift towards enhanced in-store experiences. Monobrand stores, in particular, are leading this change. In our group’s experience, personalised clienteling has been instrumental in attracting luxury consumers who are eager to return to face-to-face interactions, thereby demonstrating a preference for a more tailored and intimate shopping experience. This era is about leading change, not just adapting to it. Luxury brands that can effectively harness shifts in wealth demographics, consumer expectations, and technological advancements are set to succeed. The evolving luxury landscape continues to demand a blend of exclusivity, responsibility, innovation, and authenticity, all tailored to meet the diverse needs of a global consumer base, just as it has in the past.

On-trend in China

China has been a reference for luxury goods for decades and the diversity within China’s regions plays a critical role in shaping the luxury market. For example, while mainland China has shown strong performance post-reopening, emerging economic challenges have hinted at potential slowdowns. In contrast, Hainan’s Sanya Haitang Bay is on track to become a new luxury hub, set to transform into a duty-free island by 2025, which could significantly alter the luxury retail landscape.

The retail landscape is witnessing a remarkable shift towards enhanced in-store experiences

Furthermore, Bain & Company forecast that by 2030, Chinese consumers are expected to reclaim their pre-Covid-19 position as the leading nationality for luxury goods, accounting for 35–40 percent of global purchases. Additionally, mainland China is anticipated to surpass the Americas and Europe, becoming the largest luxury market worldwide, representing 24–26 percent of global purchases.

While the luxury sector faces a complex array of challenges in 2024, the opportunities within China’s expanding and evolving market are significant. Brands that can navigate these complexities with strategic agility, a strong digital presence, and a commitment to sustainability are likely to outperform and continue to captivate the sophisticated and increasingly diverse luxury consumer base in China and beyond.

Must-haves in the Middle East

The Middle East is experiencing significant economic growth, driven by government investment of energy sector revenues into new economic areas. This is fostering a notable increase in wealthy families in the region. Projections suggest that by 2027, the number of high-net-worth individuals (HNWI) in the Middle East will increase by 82.4 percent, and UHNWIs by 33 percent, exceeding the global growth rate.

In addition to these trends, the Middle Eastern luxury goods market, primarily driven by the UAE and Saudi Arabia, is expected to double in size from nearly €15bn in 2023 to €30–€35bn by 2030. Saudi Arabia, in particular, is rapidly becoming a major hub for luxury, with Vision 2030 playing a pivotal role in transforming the country into a luxury destination. The country plans to develop nearly 500,000 square metres of luxury commercial real estate in Riyadh alone, including three major shopping malls. This development is aimed at retaining the luxury expenditure of Saudi nationals within the country, which is expected to grow significantly. Additionally, the proposed luxury destination in the Red Sea by Neom is anticipated to bring substantial economic growth to the area.

This burgeoning growth sets the stage for the Middle East to become an increasingly important market for luxury goods, potentially comparable to established markets such as the US, Europe, and China. The emphasis on creating a regional luxury shopping paradise, coupled with massive economic transformation initiatives, positions the Middle East as a vibrant landscape for luxury brands looking to expand their global footprint.

Redefining the industry

In 2024 the luxury sector is on the brink of a significant transformation, offering a wealth of opportunities for forward-thinking brands. To thrive, companies must innovate, evolve, and resonate with the shifting dynamics of the luxury market. The foundation of this transformation lies in understanding and engaging with the new generation of consumers who demand both authenticity and innovation.

Companies must innovate, evolve, and resonate with the shifting dynamics of the luxury market

Over the next decade, the fusion of traditional luxury values with cutting-edge technology will redefine the industry, creating a new era that appeals to a more diverse and sophisticated global audience. Brands that leverage data-driven insights, embrace seamless omni-channel experiences, and expand into emerging markets will be at the forefront of this evolution. Overall, the future of luxury is about more than just quality products; it’s about creating strong long-lasting relationships with consumers and offering them personalised, meaningful experiences that they connect with deeply.