“We always knew the guys who currently run InfoWars were going to take this badly and use the loss to fundraise off of it, and they did not disappoint,” the Onion’s CEO Ben Collins posted on Bluesky last week, adding that “Buying this site was always going to be fun later on, but annoying right away.” And boy was he ever right!

Last week Chapter 7 bankruptcy trustee Christopher Murray announced that Global Tetrahedron, parent company of The Onion, was the winning bidder in the auction of Free Speech Systems, Alex Jones’s corporate firehose of hate. The runner-up bidder was a company called First United American Companies, LLC, which would appear to be associated with one of FSS’s suppliers. FUAC’s attorney Walter Cicack previously represented Charlie Cicack in this case, and Charlie is described by the New York Times as “an entrepreneur who had sold products through Free Speech Systems in the past” and then “claimed ignorance of the relationship and then deleted references to Infowars from his social media accounts” when the paper contacted him.

At an emergency status conference on Thursday, Walter Cicack protested that Murray, the trustee, had illegally changed the terms of the auction and colluded with the Sandy Hook families to rig the auction in favor of a party who put less cash on the table. And US Bankruptcy Judge Christopher Lopez appeared sympathetic, despite Murray’s protests that he’d done what was in the best interests of all the creditors.

This morning, Cicack filed an emergency motion to disqualify The Onion’s bid on the theory that Murray violated the court’s winddown order authorizing the sale. It was chock full of highly inflammatory claims that Murray acted “in complete bad faith and with improper collusion with the Connecticut Families.”

Within an hour, Murray docketed a two-page preliminary response denying the “barrage of baseless allegations, selective quoting and half-truths in FUAC’s recent filings” and “reserv[ing] all rights, including those under Federal Rule of Civil Procedure 11 and Federal Rule of Bankruptcy Procedure 9011 regarding the duties of attorneys who sign their names to pleadings in this Court.”

Then this afternoon, Murray filed an expedited motion to ratify the sale making clear why he chose The Onion’s bid, even though it was for less cash upfront.

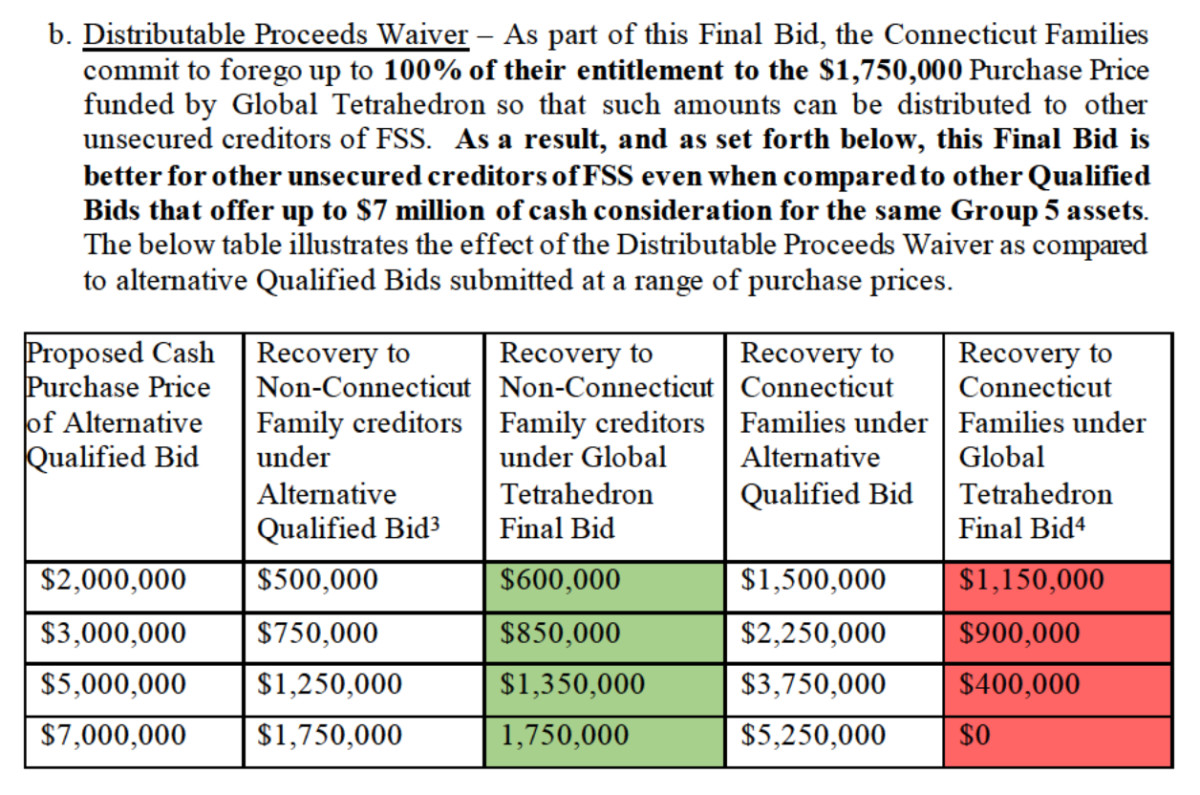

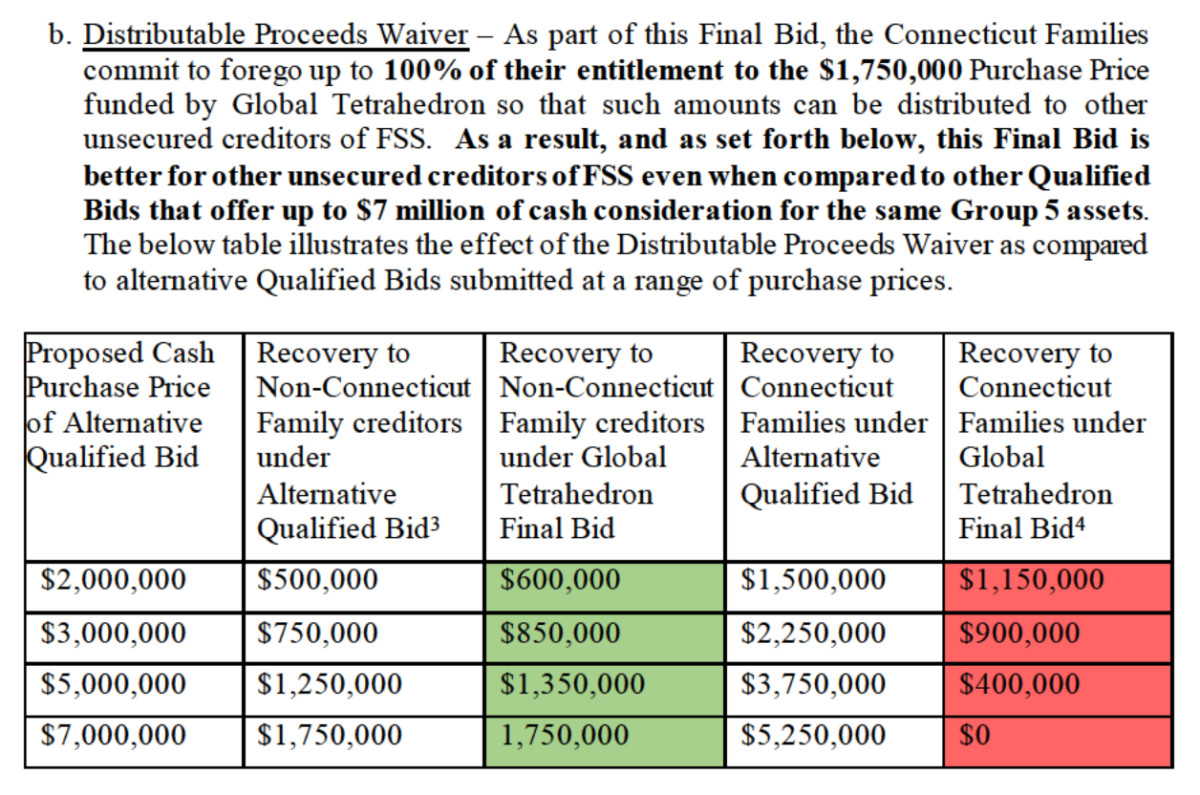

Thanks to the numerous exhibits, the sealed auction negotiations have now been functionally unsealed (with the exception of the identity of FUAC and its funders). FUAC’s initial bid was $1.2 million, and The Onion’s was $1 million. But The Onion’s bid included a Distributable Proceeds Waiver by the Connecticut plaintiffs in favor of the Texas plaintiffs addressing a rift between the two sets of Sandy Hook parents that opened up when FSS exited Chapter 11 proceedings.

In brief, the Connecticut plaintiffs have a $1.4 billion judgment; and the Texas plaintiffs have a $50 million judgment. And so, under a pro rata distribution of assets, the Texas plaintiffs are going to get just three percent of the payout. And so, to address this disparity, while simultaneously ensuring that Jones doesn’t get to keep the company, the Connecticut plaintiffs agreed to disclaim as much of the sale proceeds as necessary to make the Texas plaintiffs $100,000 better off than they would be under the second-place bid.

To the extent an alternative Qualified Bid is submitted by a third party that consists of cash consideration in a higher amount than the Purchase Price set forth herein, the Connecticut Families commit to forego receipt of the Distributable Proceeds Waiver Amount (as defined herein), and shall assign the Distributable Proceeds Waiver Amount to the Chapter 7 Trustee for the benefit of all other unsecured creditors of FSS. The waiver described in this section (the “Distributable Proceeds Waiver”) is intended to enhance the terms of this Bid, such that creditors other than the Connecticut Families will receive greater cash recovery pursuant to this Bid than they would under an alternative Qualified Bid, notwithstanding a higher cash purchase price.

Murray went back to both FUAC and The Onion and asked them to submit their best and final offers, as was within his discretion according to the plain language of Judge Lopez’s order authorizing the sale. Notably, FUAC did not object at the time to the change in procedures.

The submissions were to include bids on multiple different lots, in varying combinations, since the assets include Infowars’ IP, the Infowars store, various domain names, and the FSS’s tangible personal property.

View the original article to see embedded media.

This appears to have been an effort to extract maximum value for creditors by selling the IP to The Onion, and the store, which The Onion didn’t care much about, to FUAC.

FUAC came back with a bid for $3.5 million. The Onion’s bid was $1.75 million. But it was accompanied by a promise from the Connecticut families to disclaim as much of the purchase price as necessary to put the Texas families in a better position than they would have been with the FUAC deal, even if FUAC raised its offer to $7 million.

To be clear, the Connecticut plaintiffs calculated this by grossing the share of all other creditors up to 25 percent. In reality, everyone else’s claims against the Jones estate are just a rounding error compared to the $1.4 billion plus post-judgment interest the Connecticut plaintiffs entitled to. And, despite Cicack’s suggestion that The Onion was bidding with “monopoly money,” the Sandy Hook parents will get a continuing share of the ad revenue post-sale.

So Murray, exercising his broad discretion under the winddown order and the business judgment rule, chose the offer that maximized value to the creditors, even though it was not the deal that put the most cash on the table up front.

Presumably he will respond to Cicack’s attack in short order. Wonder if we’ll find out exactly which goblinlover is behind that FUAC bid …

Liz Dye lives in Baltimore where she produces the Law and Chaos substack and podcast.

For more of the latest in litigation, regulation, deals and financial services trends, sign up for Finance Docket, a partnership between Breaking Media publications Above the Law and Dealbreaker.